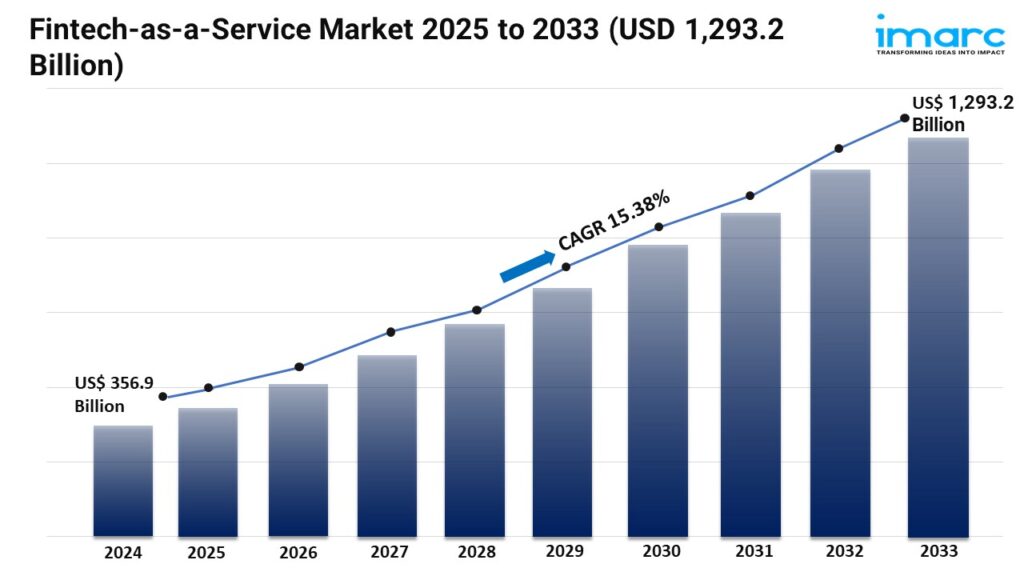

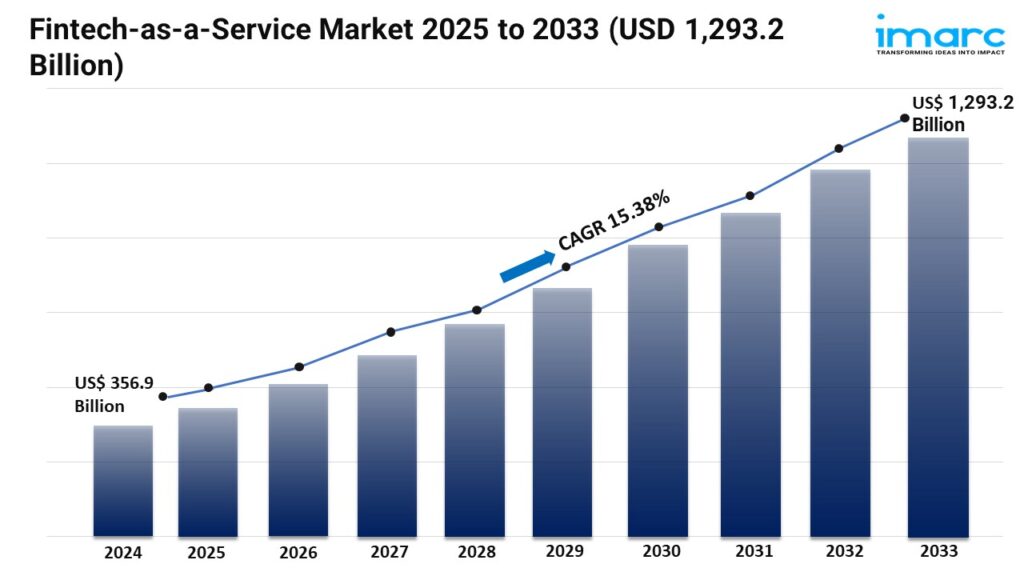

IMARC Group’s report titled “Fintech-as-a-Service Market Report by Type (Payment, Fund Transfer, Loan, and Others), Technology (API, Artificial Intelligence, RPA, Blockchain, and Others), Application (KYC Verification, Fraud Monitoring, Compliance and Regulatory Support, and Others), End Use (Banks, Financial Lending Companies, Insurance, and Others), and Region 2025-2033” , The global fintech-as-a-service market size reached USD 356.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 15.38% during 2025-2033.

Factors Affecting the Growth of the Fintech-as-a-Service Industry:

APIs drive the fintech-as-a-service boom in 2024. Companies embrace modular solutions, integrating diverse financial offerings swiftly. This approach accelerates product launches, enhances market responsiveness, and boosts customer satisfaction. FaaS partnerships unlock specialized services - payments, lending, insurance - without hefty investments or technical hurdles. Businesses leverage these plug-and-play options, transforming their platforms with ease.

As the FaaS market grows in 2024, cybersecurity and data privacy are more critical than ever. With more digital financial services, the risks of cyberattacks and data breaches are increasing. Cloud providers prioritize robust security for FaaS offerings. Clients demand encryption, rigorous authentication, and constant monitoring. Both parties collaborate to safeguard data and systems. These measures protect against threats while enabling scalable, efficient serverless computing.. They are also ensuring compliance with data protection regulations like GDPR and CCPA to build trust and avoid legal issues.

AI and machine learning (ML) are revolutionizing the fintech-as-a-service market in 2024. AI chatbots now offer round-the-clock support, enhancing customer service. From spotting scams to offering tailored financial advice, banks harness cutting-edge tech. Machine learning analyzes data instantly, powering smarter business decisions. These tools safeguard accounts and optimize client finances. Across industries, such advancements boost efficiency and inform choices. The result? Streamlined operations and sharper strategies, all driven by AI's analytical prowess.

Grab a sample PDF of this report: https://www.imarcgroup.com/fintech-as-a-service-market/requestsample

Leading Companies Operating in the Global Fintech-as-a-Service Industry: